Many people mistakenly believe that if they overpay on a mortgage by 1.7 times the purchase price, they won’t make anything unless the price of the property rises by at least the same amount.

Short answer: it’s not true.

A more detailed explanation

There were dozens of comments (and over two thousand likes) on social media under one of my Instagram videos. Let’s focus on one of them. Failure to understand it will mean you will never use leverage and may deprive yourself of the real wealth creation that real estate offers.

Link to Instagram video (Czech language) >>

When an investor overpays on a mortgage, it doesn’t mean that the property has to go up by the same amount to make the investment worthwhile when they sell.

Why? There are two key variables in the calculation: return on investment (ROI) and cashflow.

There are many ways to calculate ROI, here is one of them

Firstly, ROI is a theoretical figure that can only be accurately determined when the property is sold. It includes the difference between the purchase price and the sale price (after deducting the purchase costs, taxes, adjustments, legal fees, etc.).

Four types of investment property: the management intensity scale >>

Secondly, cashflow represents what the investor sees in his account each month – regular income and expenses. It is a living figure, similar to the flow of blood in the body, which is why it is called the “flow” of money. It includes the time the apartment is vacant, minor repairs, rental costs, rental income, etc. However, the cost of financing, i.e. the mortgage payment including interest, is essential.

Now, to answer the opening question

The interest part of the mortgage payment is covered by the tenant paying us rent. This expense is therefore included in cash flow. Without the tenant and his payment, the property would become a liability instead of an asset. This would leave us reliant only on the property’s appreciation in value, which would only be reflected in ROI.

But because someone is living in the apartment and paying rent that covers expenses and still has some left over, we don’t have to worry about overpaying, say, twice on the mortgage in twenty or thirty years. That is why it is very IMPORTANT that cash flow is always positive.

Current investment offer in England >>

I never recommend topping up on a mortgage when the rent will not cover the repayments. It is an inexcusable transgression to get into the red every month and acquire a property knowing this.

The property would be a liability, which makes no sense. Or speculation. Not an investment. Many people speculate, not invest. That’s fine as long as you don’t confuse the terms. Nothing against speculation.

Reading some of the comments below the video mentioned, it’s clear to me why more people aren’t investing in real estate, much less mortgaging. They just don’t understand basic economics, which is fundamental at the same time.

Example – return on investment

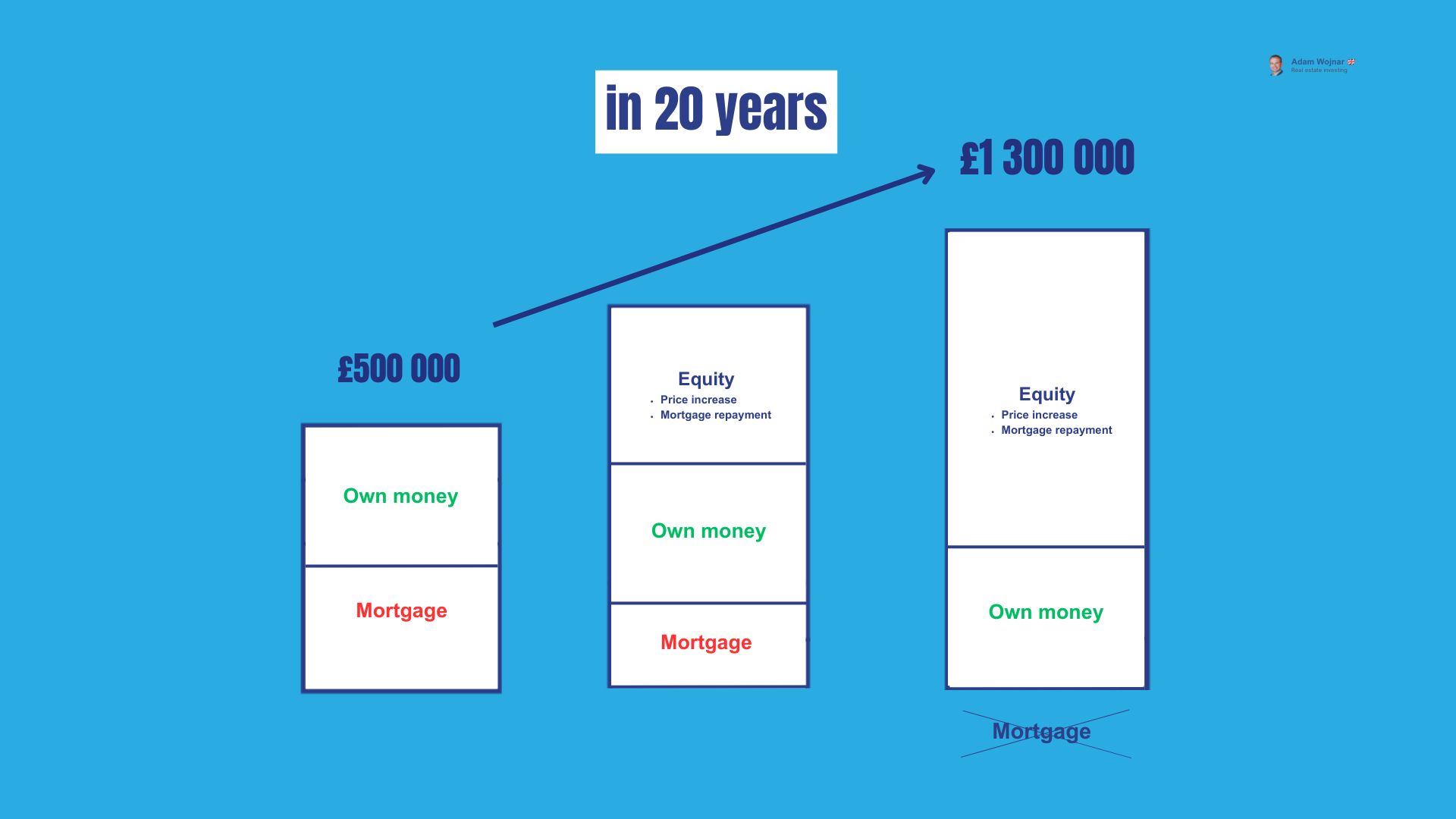

As an example, let’s take an investment apartment worth £500 000.

In 20 years, the apartment can reach a value of 1 300 000,-. Maybe higher, maybe lower. This is not relevant now. The important thing to remember is that real estate investment pays off when it is a long-term investment. Not just a short-term speculation or flip (cheap to buy, expensive to sell). Long term holding pays off and when it’s packaged with a mortgage, then it makes a lot of sense.

- Invested amount £250 000 (including all fees).

- Loan (mortgage) £250 000.

- Estimated selling price 1,3 million.

- Profit £1 500 000,- which is 5 times the original invested amount of £250 000.

The apartment is rented out, so we are not interested in expenses for repairs, time without a tenant, interest on the mortgage, etc. at the moment. These costs are reflected in the cash flow statement. If the apartment were vacant, then it would be something other than an investment. We are discussing investment apartments here, nothing else.

Example – cash flow

After purchase, the apartment can be rented out for £2 000 (hypothetically much more). The mortgage (including the interest mentioned above) and the prescription of the advance payments swallow a large part of it. The investor gets £200 profit every month. It is not much. Notice what happens in twenty years.

There is no need to wait that long for the investor to start reaping the rewards. In my experience, after five years the investment becomes more interesting.

- At the beginning, the rent is £2000 a month.

- After twenty years, rent £5 300 per month (if the rent would grow with inflation, which it does).

- The debt is paid off in that time – no mortgage payment (if interest only, debt not paid up).

- The investor pays only the prescription of advances.

- The vast majority of the rent is left for him. In our case it is £4 800 (estimate).

Conclusion

Investing in real estate through a mortgage can be very profitable if we understand correctly how key financial metrics like ROI and cashflow work. An incorrect perception of these principles can lead to mistakes that can discourage investors. Properly understanding and applying these concepts can be the key to success and long-term wealth growth.

If you buy with an interest-only mortgage product, the income would be higher. The model above is just an example.

Adam Wojnar